Table of Contents

Table of Contents

Video Transcript

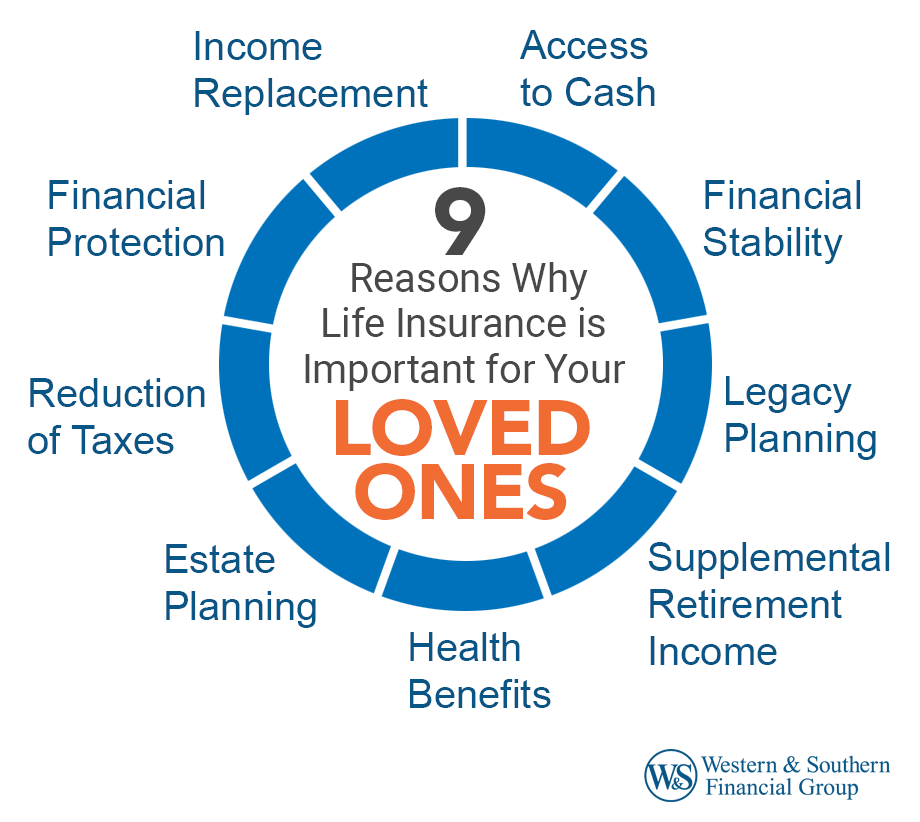

Whether you're a parent, partner, or provider, having life insurance is crucial to protecting the financial security of your loved ones.

First, life insurance provides financial protection, covering expenses like medical bills, funeral costs, debts, and more, to ease the burden during difficult times. Second, life insurance can replace your income, ensuring your family's financial stability even when you're no longer there. Third, some life insurance policies accumulate cash value over time, offering a financial buffer for unexpected expenses.

Fourth, life insurance provides financial stability during tough times, like covering funeral costs and immediate expenses. Fifth, life insurance can be used for legacy planning, leaving a financial inheritance for loved ones or supporting charitable causes. Sixth, life insurance can supplement your retirement income, providing a financial cushion in your golden years.

Seventh, life insurance riders can offer important health benefits, providing financial support in case of serious illness or disability. Eighth, life insurance can be used as an estate planning tool, helping to cover any necessary estate taxes and final expenses. Ninth, life insurance policies can offer certain tax advantages, like a tax-free death benefit and tax-deferred cash value accumulation.

Life insurance can be a key part of protecting the financial security of your loved ones.

Understanding the 9 Reasons why life insurance is important for your loved ones can help you plan for your family's long-term financial needs.

Talk to one of our financial professionals about life insurance today. They can help you assess your needs and find the right policy for you.

Disclaimer

Interest is charged on loans, they may generate an income tax liability, reduce the Account Value and the Death Benefit, and may cause the policy to lapse.

Withdrawals may be subject to charges, withdrawals of taxable amounts are subject to ordinary income tax, and, if taken before age 59½, may be subject to a 10% IRS penalty.

Life insurance products are not bank products, are not a deposit, are not insured by the FDIC, nor any other federal entity, have no bank guarantee, and may lose value.

Life insurance policy guarantees are subject to the timely payment of premiums. Loans and withdrawals will affect the death benefit. Western & Southern Life is the marketing name for The Western and Southern Life Insurance Company, Cincinnati, Ohio. Western & Southern Life does not provide tax or legal advice. Please contact your tax or legal advisor regarding your situation.

© 2024 Western & Southern Financial Group, Inc. All rights reserved.

Key Takeaways

- Life insurance helps protects your family's future, covering expenses such as medical bills, funeral costs, debts, mortgage payments, and tuition.

- Life insurance replaces income for your family in the event of your death, ensuring their financial stability and preventing immediate hardship.

- Some types of life insurance accumulate cash value over time, offering access to funds for temporary financial needs or unexpected expenses.

- Life insurance can help brings peace of mind by providing financial stability during difficult times, such as covering funeral costs and immediate expenses.

- Life insurance can be used for legacy planning, leaving a financial inheritance for loved ones, or supporting charitable causes.

Understanding the benefits of life insurance can help you plan for your family's long-term financial needs. Here are nine reasons why life insurance is important.

1. Financial Protection

Life insurance is meant to help protect your family's financial future. Buying a life insurance policy helps secure your family's financial stability if you pass and could help mitigate the stress and burden of an already difficult time. Even if you have savings, it's unlikely that it would be enough to cover your family's expenses for several years or even decades if something happens to you unexpectedly.

Typically, there are several types of life insurance options to consider: term life insurance, whole life insurance, and universal life insurance. Death benefits are usually paid in a lump sum payment. This money can cover expenses like medical bills, end-of-life costs, outstanding debts, mortgage payments, health insurance, and tuition.

Certain types of debt don't go away when you die, which means your loved ones may have to use money from your estate or sell off other assets to cover financial obligations. This could leave less money to pay for expenses. At a time when your loved ones are already dealing with your loss, life insurance can help ease some of the financial burdens they may experience from lost income after your passing and help provide a financial safety net.

2. Income Replacement

Whether you have a 9-to-5 job, are self-employed, or own a small business, your current income might cover a portion or all of your family's daily needs. Housing, food, utilities, clothing, car maintenance, outstanding loans, and health care premiums are likely all part of your monthly budget.

If you were to die unexpectedly, your other family members would still need to cover these ongoing household expenses even without your income. The life insurance death benefit can help replace income and ensure financial stability for your loved ones after you are no longer there to provide for them.

Life Insurance Calculator

When considering buying life insurance, you may consider using a life insurance calculator to help you determine how much life insurance coverage you need.

3. Access to Cash

Some types of permanent life insurance, like whole life insurance and universal life insurance, offer you the added benefit of a cash value component. As you pay your life insurance policy premiums, the life insurance company invests this money, allowing you to build cash value in the policy over time.

In the future, this cash value can be available to you through policy loans and withdrawals to take care of temporary financial needs or unexpected expenses, like a major car repair. However, remember that withdrawing funds from your cash value will reduce the amount of your future death benefit, affecting how much money your beneficiaries would receive upon your death.

Building cash value in a permanent life insurance policy is one way to create an extra emergency fund, offering you additional financial security, knowing that you can withdraw or borrow your cash value whenever needed.

Receive flexible cash access through life insurance. Get a Life Insurance Quote

4. Financial Stability

One of the most important benefits of life insurance is that it can help provide greater peace of mind, knowing that your loved ones will be taken care of in case of untimely death. For example, funerals can be expensive. Dealing with this financial stress can add to the emotional strain your family might experience.

Your family could use some of the death benefit from your life insurance policy to help pay for these funeral expenses. The policy's beneficiary could direct some of the death benefits to the funeral home for final expenses, or they can pay out-of-pocket and use the death benefit as reimbursement for these expenses.

You may rest easier by feeling secure in the knowledge that your family won't face financial hardship by relying on the death benefit that life insurance provides.

Did You Know?

The average cost of a funeral with burial is nearly $8,000, and for a funeral with cremation, it's approximately $7,000.

What is the concept of Human Life Value in life insurance?

The "Human Life Value" (HLV) concept pertains to life insurance and financial planning. It represents a person's value in terms of their financial contribution to their family or dependents. In other words, if that person were to die suddenly, the HLV would estimate the financial loss that their family would incur.

This concept can be beneficial for those determining how much life insurance they should purchase to provide financial support to ensure their family's financial stability in the event of their untimely death.

5. Legacy Planning

Many people choose to use life insurance to leave a legacy for their loved ones or their favorite charitable cause. When selecting your life insurance beneficiary, consider to whom or what you want to leave your death benefit.

For example, if you have children, life insurance can help your family pay for future childcare and education expenses, especially for college tuition. Even if you've already started contributing to a 529 college savings plan, the death benefit from a life insurance policy can provide additional money to help cover your children's education if you were to die.

You also may choose to leave a legacy through charitable giving by naming a religious, arts, or charitable organization as your beneficiary. In addition, you may decide to donate your life insurance policy directly to the charity or allow the charity to purchase a policy on your life and make annual tax-deductible contributions to the charity to cover the policy's premiums.

Plan your legacy to last generations. Get a Life Insurance Quote

6. Supplemental Retirement Income

Life insurance can also supplement your retirement income in a couple of ways. Permanent life insurance policies (either whole life policy or universal life policy) allow you to build up cash value, which you can borrow against and use as a supplemental source of retirement income.

You also have the option to use the cash value from your policy to buy an annuity, allowing you to contribute money in a tax-deferred account that can distribute regular payments to you as an ongoing stream of retirement income.

7. Health Benefits

Life insurance riders, which can offer essential health benefits, are add-ons to a life insurance policy, allowing you to personalize your life insurance companies coverage. Various riders can provide you with financial support in case of serious illness or disability or the need for long-term care. These additional protections, however, will increase your premium in many cases.

- Accelerated Death Benefit Riders provide financial relief during critical illness by allowing policyholders to access a portion of their death benefits early.

- Critical Illness Riders allow you to tap into your life insurance death benefit early if you are diagnosed with a serious illness.

- Chronic Illness Riders deliver financial support if the policyholder becomes chronically ill, often defined by an inability to perform daily activities or severe cognitive impairment.

- Long-term Care Riders offer financial support for long-term healthcare needs due to chronic illness, disability, or cognitive impairment.

- Waiver of Premium Riders waive or pay your life insurance premiums for you if you become disabled and unable to work, ensuring your policy stays in force even if you can no longer afford the premiums yourself.

8. Estate Planning

Another reason why life insurance is important for your loved ones is related to estate planning. You can use life insurance as an estate planning tool to help plan for your heirs to have sufficient liquidity (i.e., cash on hand) after you die to pay any necessary estate taxes and final expenses.

Because liquidating estate assets is time-consuming, the death benefit from life insurance can be used for faster payouts to cover funeral and burial costs, medical bills, and outstanding debts and taxes. It can also help equalize estate inheritance if one heir receives real estate and another receives cash.

As a life insurance policy owner, you can decide how the policy's death benefit should be used. People can use their life insurance policies death benefits for a variety of estate planning purposes: to continue financially supporting an aging parent or a child with a disability, pay alimony, or make child support payments. Proceeds from life insurance can also fund a trust for another purpose.

9. Reduction of Taxes

Life insurance policies can offer certain tax advantages. First, the life policy death benefit is generally paid out to your beneficiary free of income tax. Consequently, a sizeable death benefit will avoid a hefty payment of income tax.

By contrast, most retirement plan proceeds received by beneficiaries will typically be taxed by the IRS. And while life insurance death benefits are generally exempt from income tax, they are not usually exempt from federal estate tax. However, you can establish an irrevocable life insurance trust (ILIT), which can exclude life insurance proceeds from the taxable estate and transfer the death benefit immediately to beneficiaries.

The second tax advantage to keep in mind is that the total cash value for a permanent life insurance policy (i.e., whole or universal life) accumulates tax-deferred. As a result, your cash value nest egg will grow faster because money is not being taken out for taxes. In addition, when you access money from your cash value, you can generally withdraw an amount equal to what you have paid in premium payments without paying any taxes.

Tip

For more information about the tax advantages of life insurance regarding your specific life situation, be sure to consult with your tax accountant and/or financial advisor.

Conclusion

There are numerous benefits of buying life insurance for you to consider. Depending on your financial goals and needs, buying life insurance coverage could be an essential part of helping to protect the financial security of your loved ones. To receive more information on how to buy life insurance that's right for you, consider speaking with a life insurance agent or financial professional.

Secure your legacy with life insurance. Get a Life Insurance Quote

Sources

- 2022 Insurance Barometer Study Reveals the Secret to Financial Security is Owning Life Insurance. https://www.forbes.com/advisor/life-insurance/life-insurance-statistics/#americans-drafting-wills

- Life Insurance Statistics, Data and Industry Trends 2023. https://lifehappens.org/press/2022-insurance-barometer-study-reveals-the-secret-to-financial-security-is-owning-life-insurance/